how to check tax file branch lhdn

Before you can file your taxes online there are two things that you will need. The importance to prepare audit file is to compile all audit workings accountant report clients report correspondences and most important is the Annual Certificate Practice to prevent them from lose as well as for accounting purposes for making the opening balance.

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

Checker Maker and Viewer are present and bring along the completed documents and photocopies of the users NRIC.

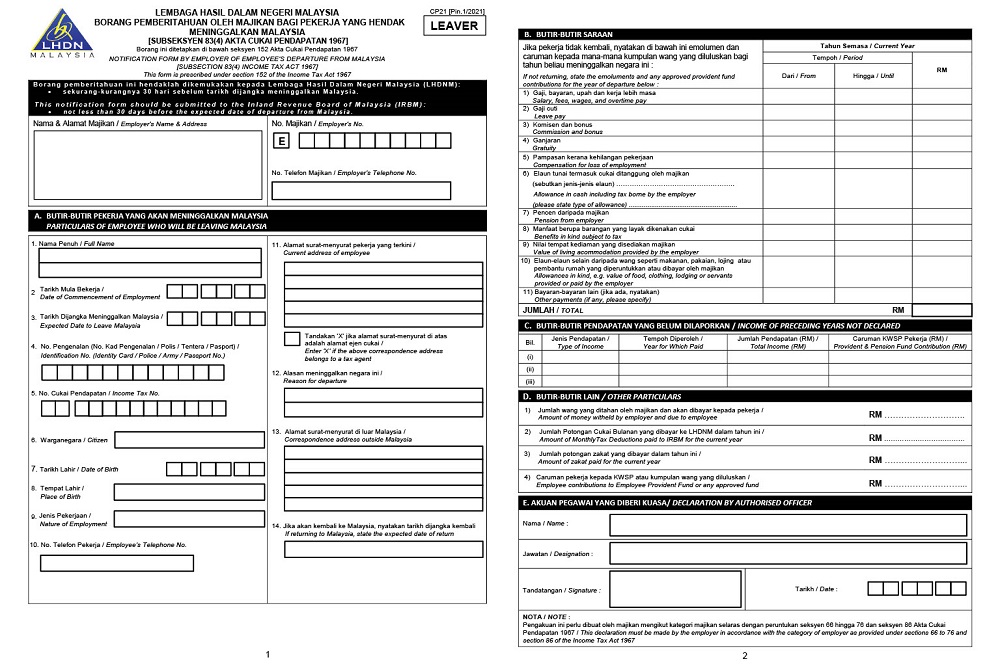

. The cheque will be processed within 14 working days from the refund approval date. Finally submit all forms and supporting documents to the nearest IRB LHDN branch within 60 days of the sale. EMPLOYER REGISTRATION FILE Please fill in these fields to register employer file.

The appeal must be made within 30 days from the date of notice in writing to the LHDN branch which issued the assessment. Two copies of Form 49 - Name and the address of the directors. You can apply to register an income tax reference number at the nearest branch to your correspondence address or at any LHDN branch without.

Alamat Kediaman Residential Address. Real Property Gains Tax RPGT is an important property-related tax in Malaysia that applies to property sellers and many are often left confused when there are multiple updates. Check out our step-by-step guide on registering as a first-time taxpayer.

LLPs that have not been registered with LHDN. The Child and Dependent Care Tax Credit. Check out last years tax rebates here.

Check if the total monthly tax deductions MTDPCB displayed is correct. Check in and out through different branches or different devices the AI will match and. The form will need to be printed out and taken to your nearest LHDN branch where you will be given a first-time login PIN.

Households with two or more children can claim up to 16000. Kindly ensure the appointed Maybank2u Biz users ie. The PCB summary will be shown on the page.

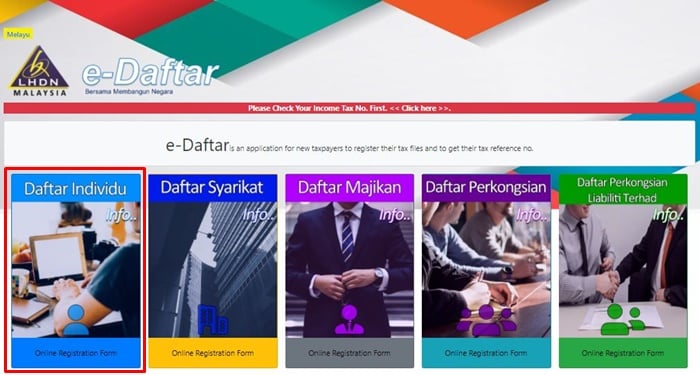

MAKLUMAT INDIVIDU Individual Information. To do so simply click on UploadValidate Text File browse the file downloaded from Talenox and click on submit button to upload. Please Check Your Income Tax No.

You can find this information in the EA Form provided by. Two copies of Form 13 - Change of company name if applicable 4. The IRS will then reimburse 50 percent of what you.

Visit this e-Drafter link and fill in all the required fields. Your income tax number and your PIN. Your tax rate is calculated based on your taxable income.

BMO Payroll Monthly Tax Deduction MTD using Computerized Calculation Method has been approved by Malaysias Lembaga Hasil Dalam Negeri LHDN. Once you successfully upload the file click on the file name to validate the result. The entered address will determine the branch of your tax file.

If unsure you can check the status of the charitable organisation on LHDN website. All forms are available at any IRB LHDN. So the more taxable income you earn the higher the tax youll be paying.

Click here to make an appointment online with your preferred branch using Maybank EzyQ our online booking system. List of income tax relief for LHDN e-Filing 2021 YA 2020 To make it easier for you to plan manage and file your income tax below is a list of tax reliefs for YA 2021 by category. Dalam Negeri Luar Negara.

Our payroll solutions are fully compliant with all local regulatory standards in Malaysia. Taxpayers with one child can submit up to 8000 of qualifying expenses while US. Partnerships that have not been registered with LHDN.

Below is the guide to step-by-step on how to register LHDN Employer Tax. You can get your income tax number by registering as a taxpayer on e-Daftar and you can get your PIN after that either online or by visiting a LHDN branch. First thing that I have to prepare is the audit file for the legal company.

Coming back to the tax exemptions and reliefs these are all the ones that were announced by the government during the 2022 Budget speech. If you plan to do this manually you can visit your LHDN branch and they will guide you accordingly. Visit the branch according to your appointment.

Businesses or companies that have employees must register an employer tax file. Check that the details and numbers in your PCB summary is correct. Two copies of Form 24 - List of the shareholders of the company.

However if you want to file your taxes online follow the steps below. Per LHDNs website these are the tax rates for the 2021 tax year. If you disagree with any of the info laid out perhaps because of a discrepancy in tax reliefs or other errors you can file an income tax appeal.

Kindly contact the LHDN Branch that handles your file or Hasil Care Line toll-free 03-8911 1000 LHDN if you still have not received after the stipulated period. The child care credit is a tax credit based on your childcare expensesUnder the regular rules the maximum credit is 35 of childcare expenses. But before that click on the link that says Please Check Your Income Tax No.

Personal Income Tax E Filing For First Timers In Malaysia

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

Ctos Lhdn E Filing Guide For Clueless Employees

How To File For Income Tax Online Auto Calculate For You

Malaysia Personal Income Tax Guide 2021 Ya 2020

31 000 Possible Tax Evaders Identified Says Lhdn Free Malaysia Today Fmt

7 Tips To File Malaysian Income Tax For Beginners

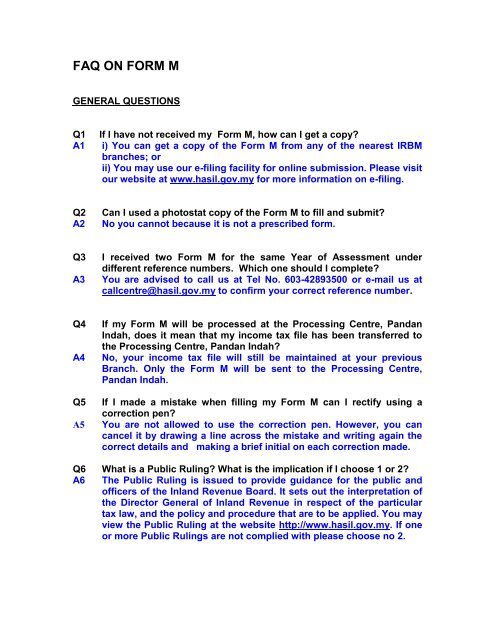

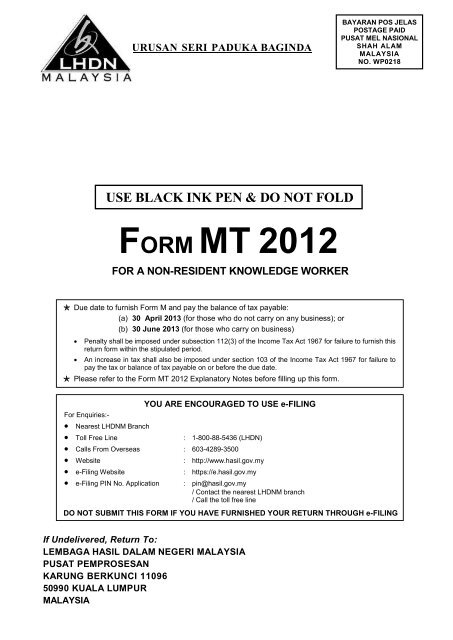

Faq On Form M Lembaga Hasil Dalam Negeri

How To Fix A Mistake In Your E Filing For Malaysians By Juinn Tan Medium

Lhdn E Filing Your Way Through Tax Season Properly

How To File Your Taxes For The First Time

Hr Guide Tax Clearance Letter Form Cp22 And Form Cp22a

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

How To File Income Tax In Malaysia 2022 Pt 2 Complete Guide To File Tax Returns Lhdn Youtube

.png)

How To Check Your Income Tax Number

What Is Permanent Establishment A Simplified Guide Velocity Global

Comments

Post a Comment